Digital Currency Resistance

The way I see it, the key is CHOICE

Choice in how you store and disperse your funds

You may well choose to do partial cash and digital currency, or entirely one or the other.

We are not helpless or hopeless. Never allow yourself to fall into that mindset. Human genius is at its most brilliant when backed into a corner. Rebels thrive in such circumstances, and show others the way out and/or the way forward and/or the way through.

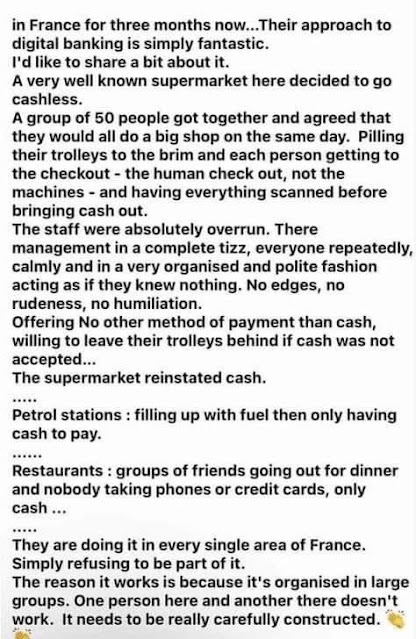

There is a lot of material online pushing people towards using only digital currency, so in this post, I'm going to add some innovative ways some folks are resisting this ... including business owners.

It might take a while for this post to become fully loaded as I come across relevant memes and graphics and stories ... but here's a start ...

Then there's this ...

Why should we pay cash everywhere we can

with banknotes instead of a credit card? 💳

- I have a $50 banknote in my pocket.

Going to a restaurant and paying for dinner with it. The restaurant owner then uses the bill to pay for the laundry. The laundry owner then uses the bill to pay the barber. The barber will then use the bill for shopping.

After an unlimited number of payments, it will still remain a $50, which has fulfilled its purpose to everyone who used it for payment and the bank has jumped dry from every cash payment transaction made...

- But if I come to a restaurant and pay digitally - Card, and bank fees for my payment transaction charged to the seller are 3%, so around $1.50 and so will the fee $1.50 for each further payment transaction or owner re laundry or payments of the owner of the laundry shop, or payments of the barber etc.....

Therefore, after 30 transactions, the initial $50 will remain only $5 😫 and the remaining $45 became the property of the bank 🏦 thanks to all digital transactions and fees.

Small businesses need your help and this is one way to help ourselves too. Pull small draws of cash out at a time and use that instead of tap, credit, etc.

When this is put into perspective, imagine what each retailer is paying on a monthly basis in fees at 3% per transaction through their POS machine.

If they have, for example, $50,000 in sales & 90% are by Card, they are paying $1500 in fees in ONE Month. $18,000 in a year! That comes out of their income every month.

That would go a long way to helping that small business provide for its family!